1

1

SETTLEMENT FUND

$1.22 BILLION DOLLARS

2

2

SETTLEMENT PERIOD

January 1, 2007 - December 31, 2023

3

3

CLAIM FILING DEADLINE

May 18, 2026

4

4

CURRENT STATUS

CLAIM FILING HAS BEGUN

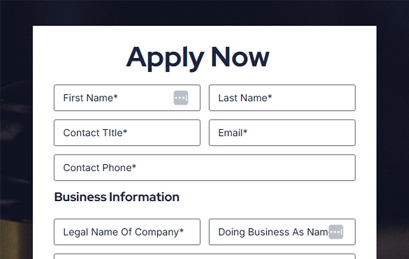

Submitting Your Claim for the Settlement: A Step-by-Step Guide

To begin claiming your share of the Discover Card Settlement, complete the intake form.

Be sure to enter your business entity’s legal name correctly, as it will be used on all official documents.

Disclaimer: Your Taxpayer Identification Number (TIN) will be requested on the initial intake form, as it is required for the Authority to Represent document. Please ensure that the individual signing the documents has the proper signing authority for the business. Titles such as “Junior” may lead to delays and require re-signing of the documents.

We operate on a contingency basis, so you only pay if we successfully recover compensation for you. Our fee for the card settlement is a flat 25% of the gross amount awarded, payable only after your compensation is collected.

Get StartedDiscover Card Class Action Settlement

Frequently Asked Questions

If your business accepted Discover credit or debit cards in the U.S. between January 1, 2007, and December 31, 2023, you may be eligible for compensation.

The Discover Card Settlement is a $1.225 billion class action resolution addressing claims that Discover Financial Services misclassified certain merchant transactions by labeling consumer purchases as commercial. This misclassification is said to have resulted in higher interchange fees for businesses. Merchants that accepted Discover card payments between January 1, 2007, and December 31, 2023 may be eligible to receive compensation from the settlement fund.

Complete the form on our website, in a week or two, you should be able to check the status of your claim. Class members do not need to sign up for any third-party service to participate in the monetary relief. Free assistance is available from the Class Administrator and Class Counsel throughout the claims-filing process.

The official settlement website is available at: https://www.discovermerchantsettlement.com/Documents

The amount your business may receive will depend on various factors, including the volume of Discover Card transactions your business processed during the eligible period and the terms of the settlement. Generally, a higher transaction volume could result in a larger award.

Payments will be based on each merchant’s estimated interchange fee overcharges tied to their Discover Merchant IDs (MIDs), how those fees were shared among acquirers or intermediaries, and the total amount of valid claims. Full details are available in the Long Form Notice on the Documents page.

The deadline to submit a claim is May 18, 2026. File your claim today to determine your eligibility.

It's recommended to consult with a tax professional, as settlement payments might be considered taxable income.

You can submit claims for multiple eligible businesses, but we need an individual claim submission form for each.

Get in touch

Contact Us Today

You can reach us using the following contact details.

- Phone: 888-532-2070

- Email: claims@cardnetsettlement.com